Human Resources Legislative Update

Ontario Seeks Comments on Proposed New Funding Rules for PBGF Assessments

Date: January 22, 2018

Much anticipated proposed regulatory amendments respecting the formula for calculating Pension Benefits Guarantee Fund (PBGF) assessments were published by the Ontario government on January 19, 2018 (Proposed Regulations). The PBGF insures a minimum level of pension benefits in the event that a defined benefit pension plan is wound up with a deficit and there are insufficient assets to fund all accrued pension benefits. With unproclaimed amendments to the Pension Benefits Act (Ontario) set to enhance PBGF protection by increasing the guarantee from $1,000/month to $1,500/month, the proposed changes to the PBGF assessment formula are intended to maintain the viability of the PBGF.

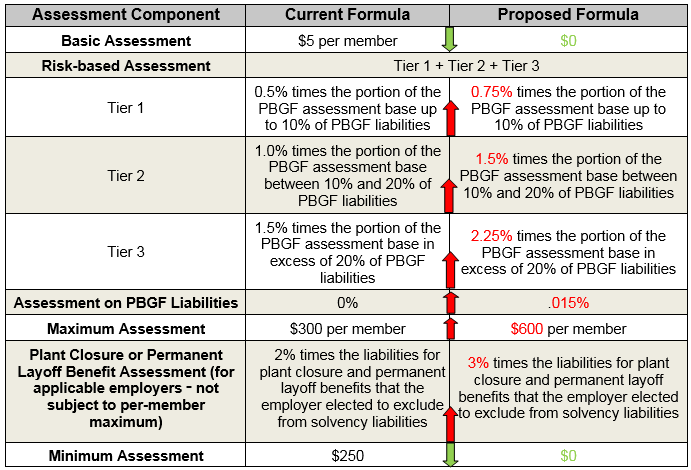

Notably, the Proposed Regulations would, among other things,

- increase the maximum assessment per member from $300 to $600 and, subject to this per member maximum,

- increase the existing risk-based assessment component by 50%

- add a new assessment component equal to .015% of a plan’s PBGF liabilities (i.e. solvency liabilities in respect of Ontario plan beneficiaries)

- eliminate the $5 basic assessment per member and the $250 minimum assessment per plan

- for employers that had previously elected to exclude all plant closure benefits and permanent layoff benefits in calculating the solvency liabilities, increase the plant closure/permanent layoff benefit assessment component by 50%.

The following table compares the current and proposed PBGF assessment formula.

Recently, stakeholder attention has been largely focused on potential reforms to the solvency and going concern funding rules, but these significant proposed changes to the PBGF assessment formula should not be overlooked in view of the additional costs that may be involved.

The Ministry of Finance is seeking stakeholder feedback by February 20, 2018.

Please contact any member of our Pension, Benefits and Executive Compensation group with any questions that you may have, or for assistance with providing stakeholder feedback.

The article in this client update provide general information and should not be relied on as legal advice or opinion. This publication is copyrighted by Hicks Morley Hamilton Stewart Storie LLP and may not be photocopied or reproduced in any form, in whole or in part, without the express permission of Hicks Morley Hamilton Stewart Storie LLP. ©