FTR Now

Comprehensive Overview of the Canada Emergency Wage Subsidy – July 2020 Update

Date: July 29, 2020

On July 27, 2020, the federal government passed Bill C-20, An Act respecting further COVID-19 measures (Bill C-20), which amends the Canada Emergency Wage Subsidy (CEWS) first enacted in April 2020 with Bill C-14, the COVID-19 Emergency Response Act, No. 2 (Bill C-14). Since April, there have been a number of changes to the CEWS. Bill C-20 implements the modified rules for the CEWS program that apply from June onward.

In this FTR Now we provide a comprehensive summary of the CEWS, including the new details of the CEWS extension to December 19, 2020, and we incorporate content from our previous firm communications dated March 30, 2020, April 2, 2020, April 9, 2020, April 13, 2020, and April 20, 2020.

Table of Contents

- The CEWS – Overview

- Claims Periods

- Basic Eligibility Conditions

- Eligible Employers

- Eligible Employees

- Eligible Remuneration

- Qualifying Decline in Revenue

- Calculating “Qualifying Revenue”

- Accounting Methods

- Revenue Decline and Subsidy for Qualifying Periods 1 – 4

- The Deeming Rule

- Subsidy Calculation

- Revenue Decline and Subsidy for Qualifying Period 5 and Beyond

- Base Subsidy Calculation (Active Employees)

- The Deeming Rule

- Top-Up Subsidy Calculation

- Base Subsidy Calculation (Active Employees)

- Calculating “Qualifying Revenue”

- Inactive Employees

- Non-Arm’s Length Employees

- Payments to Eligible Employees

- Interaction of the CEWS with Other Programs and Supports

- How to Make a Claim

- Record-Keeping Requirements

- Reporting Requirements

- Penalties for Misuse

- Public Information

CEWS – Overview

The CEWS forms a significant part of the federal government’s economic response plan to support Canadians and businesses affected by the COVID-19 pandemic. Available to eligible employers of any size, the aim of the CEWS is to encourage eligible employers to avoid lay-offs, recall previously laid-off workers, help prevent further job losses, and better position employers in Canada to more easily resume normal operations following the pandemic by maintaining their connections with their employees. The CEWS expands upon the initial 10% temporary wage subsidy (10% Subsidy) previously implemented by the federal government on March 25, 2020 under the COVID-19 Emergency Response Act and available to only certain employers.

Initially, the CEWS provided a 75% wage subsidy to eligible employers, subject to a weekly maximum of $847/week, for up to 12 weeks starting March 15, 2020, with, unlike the 10% Subsidy, no aggregate limit on the total CEWS amount that an employer may claim. On May 15, 2020, the federal government announced that it would extend the CEWS by an additional 12 weeks from June 6, 2020 to August 29, 2020. The government then engaged in consultations on the adjustments to the CEWS that would apply to the extension period. The result of those consultations are the changes set out in Bill C-20 as well as the announcement of the further extension of the program until December 19, 2020.

Claim Periods

The CEWS is designed to provide a subsidy in respect of four-week claim periods (each referred to in the Income Tax Act (Canada) (ITA) as a “qualifying period”). Initially, there were three claim periods. Bill C-20 amends the CEWS to establish an additional 5 claim periods for a total of 9 until November 21, 2020, with the possibility of a 10th period prescribed by Regulation. The claim periods are as follows:

[The Tables in this publication have been reproduced or adapted from the following government websites Adapting the Canada Emergency Wage Subsidy to Protect Jobs and Promote Growth , Additional Details on the Canada Emergency Wage Subsidy, Frequently asked questions – Canada emergency wage subsidy (CEWS)]

The rules applicable to Periods 1 through 4 are the same as those reported in our prior publications. Bill C-20 introduces new eligibility rules and a different structure for the CEWS for Periods 5 through 9. The government has announced the program will be extended to December 19, 2020, but has not provided details of the revenue reduction conditions that will be applicable to that period.

Basic Eligibility Conditions

To be eligible for a four-week qualifying period under the CEWS, an eligible employer must file an application prior to February 2021, provide an attestation signed by the individual who has the principal responsibility for the employer’s financial activities that the application is “complete and accurate in all material respects,” and have a Canada Revenue Agency (CRA) payroll account on March 15, 2020.

Bill C-20 extended eligibility to employers whose payroll is processed by and submitted through another entity’s CRA payroll account, such as a payroll service provider.

Although initially mentioned in the government’s announcements, there is no legislative requirement to make “best efforts” to top-up employees to their regular wages, and the application form and attestation do not require any statement to that effect.

Eligible Employers

Initially, the eligible employers who could qualify to use the CEWS were taxable corporations, trusts, individuals, partnerships comprised of eligible employers, certain registered charities, non-profit entities, as well as the following tax-exempt entities:

- an agricultural organization

- a board of trade or a chamber of commerce

- a non-profit corporation for scientific research and experimental development

- a labour organization or society, and

- a benevolent or fraternal benefit society or order.

Eligible taxable corporations include Canadian subsidiaries of foreign corporations, publicly-listed corporations, corporations controlled by public corporations, and non-resident corporations that pay taxes in Canada and otherwise meet the eligibility requirements.

In May, the federal government extended eligibility for the CEWS to the following additional prescribed employers:

- partnerships held by both eligible and non-eligible employers, as long as at least 50% of their fair market value is held – directly or indirectly, through one or more partnerships – by one or more eligible entities

- Indigenous government-owned business corporations and partnerships consisting of Indigenous governments and eligible employers

- registered Canadian Amateur Athletic Associations;

- registered journalism organizations, and

- non-public colleges and schools.

These amendments were retroactive to April 11, 2020 and therefore apply to the first claim period starting March 15 and subsequent periods.

Public institutions are not eligible for the subsidy. These include schools, school boards, hospitals, health

authorities, public universities and colleges, and certain types of governmental organizations. The list of governmental entities defined as “public institutions” excluded from eligibility for the CEWS include:

- municipalities and a “municipal or public body performing a function of government in Canada” (MPBPFG). Note that in the past, the CRA has stated that it considers an “Indian band or council,” an economic development corporation, a regional county municipality, and an improvement district to be a MPBPFG,

- corporations owned by a municipality or a MPBPFG if at least 90% of the shares are owned by the municipality and at least 90% of the corporation’s income is earned within the geographical boundaries of the municipality,

- Crown corporations (including those owned by a province) where at least 90% of the shares are owned by the Crown/province, and

- certain subsidiaries of Crown corporations.

Registered charities and non-profit organizations are ineligible for the CEWS if they are considered a “public institution.” Employers, particularly publicly-funded organizations and trusts, should consult their corporate or tax counsel to confirm whether their organization’s structure is eligible or ineligible.

Bill C-20 provides clarity with respect to the eligibility of successor entities where two or more employers have merged or amalgamated. Corporations formed from an amalgamation of two or more predecessor corporations (or where a corporation is wound up into another) are permitted to combine qualifying revenues to determine if the prescribed decline in qualifying revenue is met, unless it is reasonable to consider that one of the main purposes for the amalgamation (or the winding up) was to qualify for the CEWS.

Rules addressing eligibility where an employer has purchased all or substantially all of the assets of another employer have also been added by Bill C-20. These allow the employer (or the employer and seller, if the seller continues to exist) to elect to take the related revenue of the seller into account when calculating the purchasing employer’s revenue under the CEWS, as long as the acquired assets were used by the seller in the course of its business carried on in Canada and it is reasonable to conclude that none of the main purposes of the purchase was to increase the amount of subsidy claimed under the CEWS. If the purchasing employer cannot itself meet the payroll account conditions as of March 15, 2020, it will be deemed to have met them if the seller met them on that date.

It also clarified that tax-exempt trusts are not eligible unless they are a registered charity or one of the other types of eligible tax-exempt entities, or if the trust is a public institution, it must be a prescribed organization in order to be eligible. This change applies in respect of the third claim period running from May 10 to June 6, 2020 and subsequent periods.

Eligible Employees

The CEWS applies to employees employed in Canada by the eligible employer, including non-arm’s length employees, new hires and employees returning to work from leaves of absence. The CEWS can be claimed for employees whether they are actively working or not.

For Periods 1 – 4, an employer cannot claim the CEWS for employees who have been without remuneration with respect to 14 or more consecutive days in the relevant four-week claim period. This requirement is eliminated effective July 5, 2020 for Period 5 and beyond.

Eligible Remuneration

The CEWS is available in respect of “eligible remuneration paid” to employees with respect to any of the weeks in the applicable claim period, capped at $1,129 per week. Eligible remuneration includes salary, wages, and other amounts paid to the employee that would normally be subject to tax withholding, such as controlled gratuities, but does not include severance pay (i.e., retiring allowances), or items such as stock option benefits or the standby charge for personal use of an employer vehicle. Vacation pay may be eligible in certain circumstances.

For the purpose of the CEWS calculation during Periods 1 – 3, “baseline remuneration” or “pre-crisis remuneration” is determined by averaging the weekly eligible remuneration paid to an eligible employee during the period beginning January 1, 2020 and ending March 15, 2020, or during the period beginning March 1, 2019 and ending May 31, 2019. The addition of a comparison period in 2019 is targeted at employees who have recently returned from an extended leave of absence (for example, a parental leave), are employed on a seasonal basis, or were recently on a reduced hours schedule.

For Period 4, an employer can elect to calculate the pre-crisis remuneration of an employee based on the average weekly remuneration paid to the employee during one of three periods: January 1, 2020 to March 15, 2020; March 1, 2019 to May 31, 2019; or March 1, 2019 to June 30, 2019.

For Period 5 and subsequent periods and for inactive employees only, pre-crisis remuneration can be based on the average weekly remuneration paid to the employee during either January 1, 2020 to March 15, 2020 or during July 1, 2019 to December 31, 2019.

For Period 5 and on, the CEWS is calculated for active arm’s length employees only on actual remuneration paid with respect to the claim period. Baseline remuneration is not part of the CEWS calculation for active employees during these periods.

In all cases, the calculation of baseline remuneration excludes any period of 7 or more consecutive days for which the employee was not paid. Employers can choose which period to use for the baseline calculation on an employee-by-employee basis.

There are anti-avoidance provisions preventing arrangements to artificially inflate earnings in order to increase the amount of the subsidy claimed. Payments to employees that are to be repaid to the employer, whether directly or indirectly, are also excluded from eligibility for subsidization under the CEWS.

Qualifying Decline in Revenue

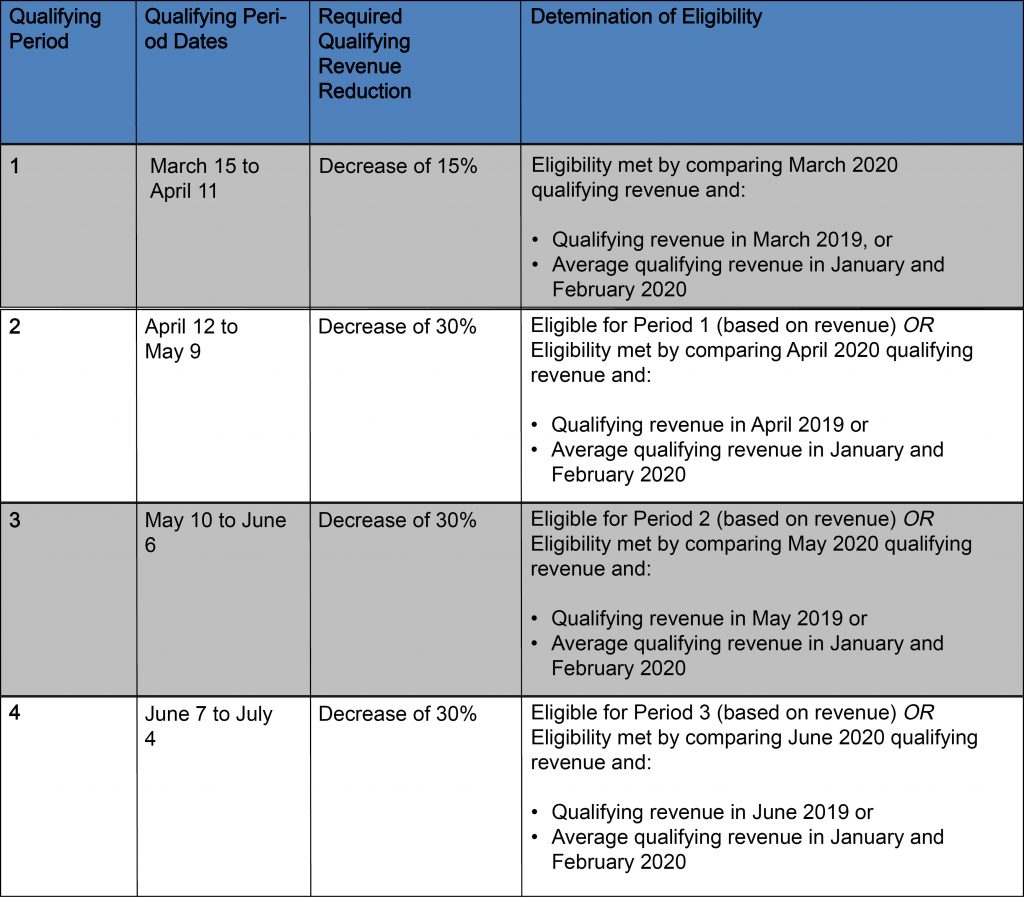

For the periods covering March 2020 through June 2020 (i.e., Periods 1 – 4), the CEWS is available to eligible employers who have faced a 15% decline in qualifying revenues earned from carrying on business in Canada in the first claim period (March 15 to April 11, 2020), or a 30% or more decline in subsequent three claim periods (see summary table below).

For July 2020 onward (Periods 5 and beyond), the CEWS is available to any eligible employer who experiences a decline in revenue, with the amount of the subsidy varying depending on the extent of the decline in the current period and the average decline over the prior three months.

Calculating “Qualifying Revenue”

Qualifying revenue includes cash, receivables, or other consideration from the eligible entity’s ordinary business activities in Canada and derived from arm’s length persons or partnerships.

Revenue from extraordinary items, amounts derived from non-arm’s length sources, and amounts on account of capital are excluded. Also excluded are amounts received pursuant to the CEWS and the 10% Subsidy.

There are detailed provisions for calculating the qualifying revenue of related entities. For example, affiliated entities are able to calculate revenue on a consolidated basis, provided they all elect to do so. If a group of eligible employers normally reports financial results on a consolidated basis, the employers in that group can elect to determine revenue separately for the purposes of the CEWS, but again, they must all make the same election. If an employee works for more than one related employer, the total amount of the subsidy received by those employers cannot exceed the amount of the subsidy calculated as if the employee had only worked for one of the employers. In addition, there are rules addressing the situation where an employer sells all of its products to a related company, as is often the case for some employers in manufacturing sectors.

For registered charities, qualifying revenue includes revenue from related businesses, gifts and other amounts received in the course of its ordinary activities. For non-profit organizations, qualifying revenue generally includes membership fees and other amounts received in the course of ordinary activities. Registered charities and non-profit organizations can choose whether or not to include revenue from government sources when applying for the CEWS, but must take the same approach for each claim period.

Accounting Methods

Employers may determine qualifying revenue in accordance with their normal accounting practices. If the normal accounting practices of the employer are the accrual method, the employer may elect to calculate its revenue under the cash method instead, but not a combination of both. The alternative “cash method” for determining revenue is described in section 28(1) of the ITA (normally used for farming and fishing businesses), modified as necessary in the circumstances. Bill C-20 clarifies that if the employer normally uses the cash method, it can instead elect to use the accrual method to calculate its revenues for the purpose of the CEWS.

Once chosen, the accounting method must be used for all claim periods.

Revenue Decline and Subsidy for Qualifying Periods 1 – 4

To establish whether the required revenue decline has occurred, all eligible employers can compare qualifying revenue for March, April, May and June 2020 either to the same month in 2019 (general approach) or to the average revenue earned in January and February 2020 (alternative approach), as described in the summary table below. The same comparison method must be used for all claim periods.

The Deeming Rule

If an eligible employer has experienced the required reduction in revenue for a claim period in Periods 1 – 3, the employer is automatically deemed to have experienced the required reduction in revenue for the next claim period.

The required decline in revenue and relevant comparison periods for each of Periods 1 to 4 are summarized in the following table.

The amount of wage subsidy received by the employer in a given month will be ignored for the purpose of measuring year-over-year changes in monthly revenue.

Subsidy Calculation

If an employer is eligible for CEWS in Periods 1 – 4, it could receive up to 75% of remuneration paid to eligible arm’s length employees (up to $847 per week per employee), calculated as follows:

- The greater of X and Y, where:

X = 75% of eligible remuneration paid to the eligible employee, to a maximum of $847/week

Y = the total amount of eligible remuneration paid to the eligible employee, to a maximum of $847/week, or 75% of the employee’s “baseline remuneration”, whichever is less

Minus

- The total amount received under the 10% Subsidy for the qualifying period

Minus

- The total amount of work-sharing benefits received by the eligible employee for the qualifying period (described below).

Plus

- The total amount of employer premiums and contributions paid on account of Employment Insurance (EI), the Canada Pension Plan (CPP), the Quebec Pension Plan (QPP) and the Quebec Parental Insurance Plan (QPIP) with respect to eligible employees on leave with pay during the qualifying period (this refund can be claimed through the CEWS application process).

An eligible employer can claim the subsidy for new employees, but would be limited to the first branch of the calculation, i.e. 75% of the remuneration paid to the employee with respect to the period.

Remuneration paid to non-arm’s length employees is also eligible for the subsidy, but limited to the second branch of the test ,i.e. the lesser of the amount paid to the employee and 75% of baseline remuneration.

Revenue Decline and Subsidy for Qualifying Period 5 and Beyond

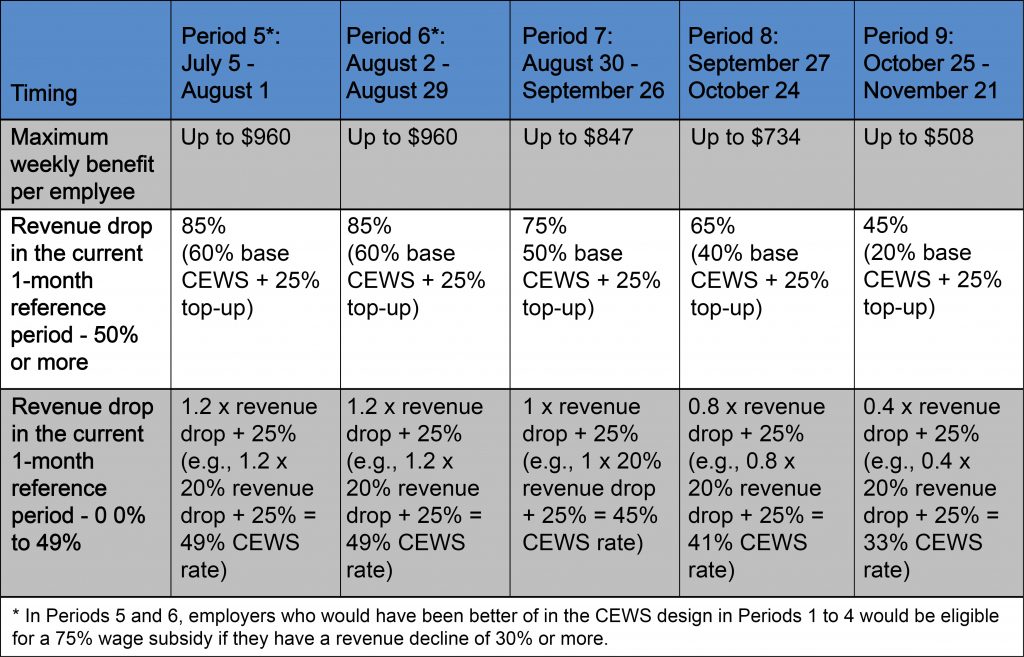

Effective July 5, 2020 (beginning for Period 5), Bill C-20 amended the CEWS framework to introduce a base subsidy and a top-up subsidy. As noted above, any eligible employer who experiences a revenue decline of any amount, including one that is less than 30%, may receive a CEWS subsidy, with the value varying depending on the extent of the revenue decline. The base subsidy is available for any eligible employer that has experienced a decline in revenue. The top-up subsidy is intended to assist those employers most affected by the COVID-19 pandemic. The value of the base subsidy will decline as the CEWS winds down over 2020.

The government also introduced a difference in the subsidy available depending on whether an employee is actively working for the employer or has been “furloughed” (i.e. on a leave of absence with pay).

For Periods 5 and 6, a “safe harbour” provision ensures that an employer will not receive less than the employer would have received if the 75% subsidy continued to apply as it did in Periods 1 – 4. This means eligible employers who have at least a 30% revenue decline in July and August will calculate the subsidy based on the greater of the rate applicable under the new rules and the “old” 75% rate.

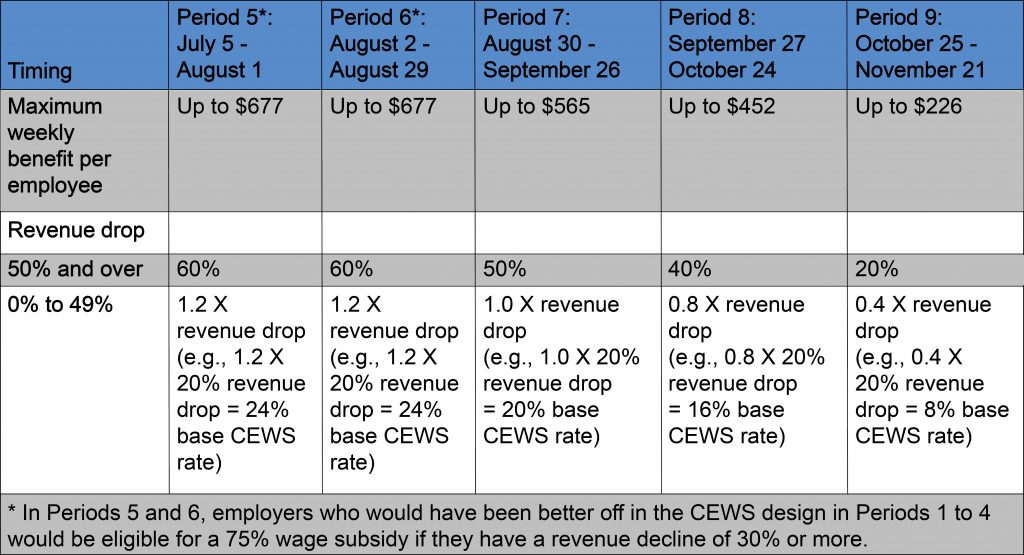

Base Subsidy Calculation (Active Employees)

In Periods 5 and 6, the maximum base subsidy is 60% for eligible employers that have experienced a decline of 50% or greater in monthly revenues for the current period. This equates to a maximum weekly base subsidy of $677. The maximum base subsidy rate gradually declines to 20% in Period 9, equivalent to a maximum weekly base subsidy of $226 for that period. The subsidy rate will be lower for employers whose revenue drops by less than 50%. The rate for Period 10 (December) has not been specified and will be set by Regulation.

The following illustrates how the base subsidy rate is calculated in Periods 5 – 9 for employers with a revenue decline of 50% or more and for employers with a revenue decline of less than 50%:

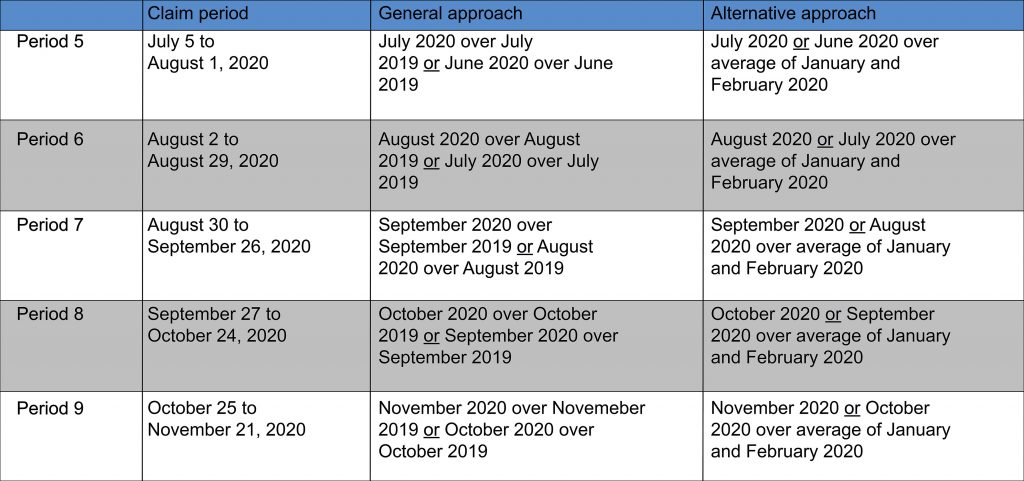

For Periods 5 onward, the decline in revenues can continue to be determined by comparing the current month’s revenue to the corresponding month in 2019 (general approach) or to the average revenues in January 2020 and February 2020 (alternative approach). An employer that was using general approach in Periods 1 – 4 can switch to the alternative approach, and vice versa, starting in Period 5. However, once the approach for Period 5 is set, the employer cannot switch again for subsequent periods.

The following table sets out the general approach and alternative approach for Periods 5 – 9:

The Deeming Rule

As the 30% revenue reduction requirement has been replaced for these periods, the deeming rule has been changed. An eligible employer will now use the greater of its percentage revenue decline in the current period and the decline in the previous period for the purpose of determining its qualification for the base CEWS and its base CEWS rate in the current period.

Top-Up Subsidy Calculation

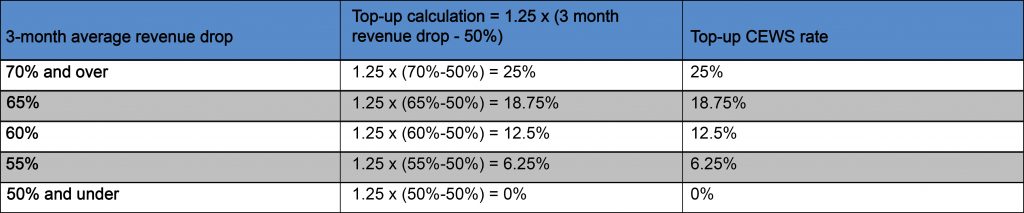

For employers whose revenue decline is more severe (averaging at least 50%), a 25% top-up of the base subsidy is available. The top-up rate is equal to 1.25 times the average revenue drop that exceeds 50%, up to a maximum top-up rate of 25%, which is attained at a 70% decline in average revenue. In Periods 5 and 6, this is equivalent to a weekly maximum subsidy of $960, which drops in subsequent periods.

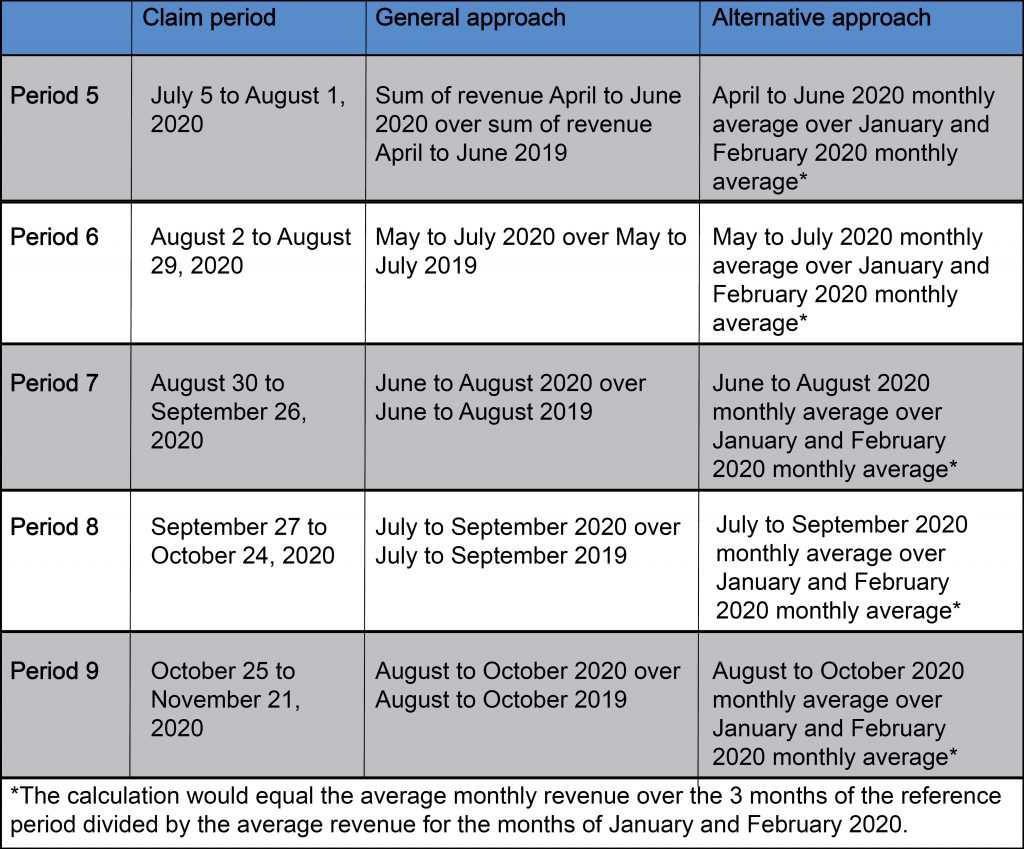

In contrast to the base subsidy calculation, the decline in revenue for the top-up rate is determined over three months instead of one month. The decline is determined either by comparing total revenue during the prior three months in 2020 to the same three month period in 2019 (general approach) or average monthly revenue over a three month period in 2020 compared to average monthly revenue in January and February 2020 (alternative approach). Once again, once an employer has elected its approach to determining the average revenue decline, it cannot switch approaches for later periods.

The following table sets out the general approach and alternative approach for Periods 5 – 9 for determining an eligible employer’s average change in revenue for purposes of calculating the top-up rate:

The following table illustrates how the top-up subsidy rate is calculated:

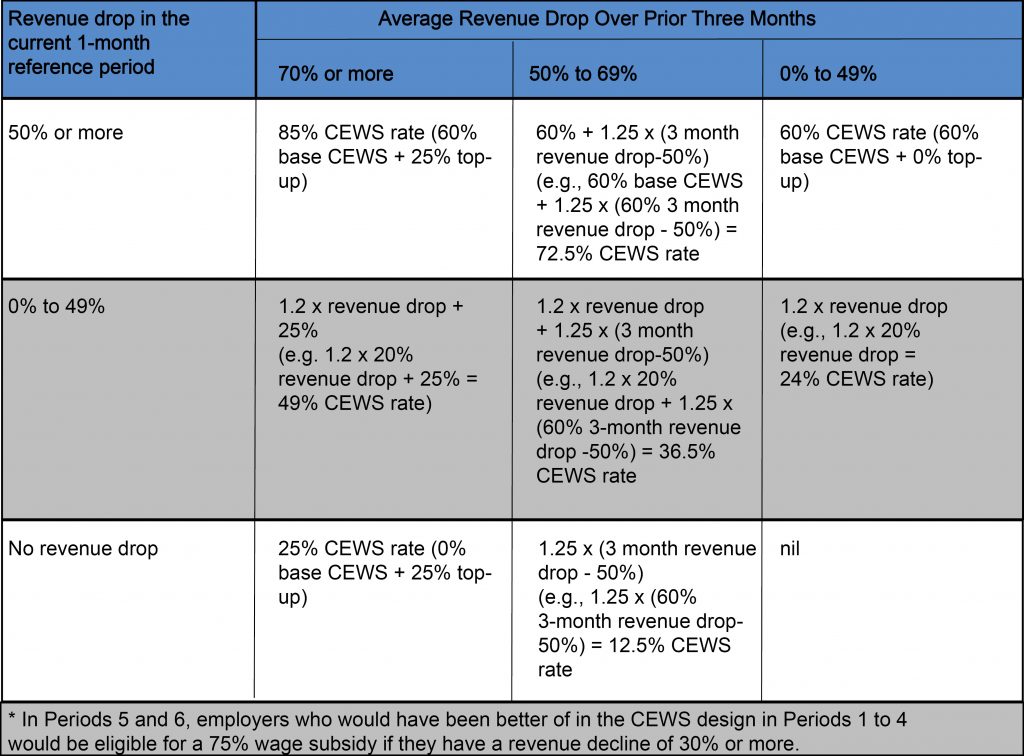

An employer’s total subsidy from Period 5 onward is equal to the base subsidy plus the top-up subsidy. The following chart illustrates the combined calculation:

The government has also provided an illustration of how the base subsidy and top-up subsidy work together, based on the extent of an employer’s revenue drop in the current one-month reference period and the employer’s average revenue drop over the preceding three months.

Inactive Employees

As part of the extension, the government has introduced a differentiation between the amount that can be claimed under the CEWS for employees who are working and employees who are not working but are being paid (i.e. who are on paid leave). The legislation does not define what constitutes “on leave with pay.”

For Periods 5 and 6, the subsidy calculation for an employee who does not work in a week would remain the same as for Periods 1 to 4. It would be the greater of:

- For arm’s length employees, 75% of the amount of remuneration paid, up to a maximum benefit of $847 per week, and

- 75% of the employee’s pre-crisis weekly remuneration (i.e., baseline remuneration) up to a maximum benefit of $847 per week or the amount of remuneration paid, whichever is less.

Starting in Period 7, the CEWS calculation for inactive employees will be based on the least of the eligible remuneration paid to the employee with respect to that week and an amount prescribed by Regulation, which the government has signalled will align with the benefits provided through the CERB and/or Employment Insurance (EI). It has not released a detailed number for this part of the calculation.

Non-Arm’s Length Employees

Amounts paid to non-arm’s length employees may be eligible for subsidization through the CEWS, provided that such employees have baseline remuneration.

For Periods 1 to 4, the subsidy for non-arm’s length employees is based on the total amount of eligible remuneration paid to the eligible employee, to a maximum of $847/week, or 75% of the employee’s “baseline remuneration”, whichever is less. For Period 5 and subsequent periods (subject to the “safe harbour” rule), the wage subsidy for active non-arm’s length employees will be based on the lesser of the eligible remuneration paid to the employee for the week or the employee’s pre-crisis remuneration, up to a maximum of $1,129, unlike the calculation for active arm’s length employees, which must be based only on actual remuneration paid with respect to the week.

Payments to Eligible Employees

In order to make a claim under the CEWS in respect of an eligible employee, the employer must have paid the employee prior to making a claim for the weeks it is claiming. The federal government has confirmed that retroactive payments are permissible prior to making a claim.

As noted above, although when the subsidy was first announced, the federal government emphasized that it expects employers who use the CEWS to make “best efforts” to top-up the wage subsidy amounts, up to employees’ pre-crisis remuneration, there is no legislative requirement to do so or to attest to doing so, and the government has considerably softened its language about topping up the amounts paid to employees.

Interaction of the CEWS with Other Programs and Supports

The 10% Subsidy:The 10% Subsidy for employers is a three-month measure that will allow eligible employers to reduce the amount of payroll deductions required to be remitted to the CRA.

If an employer is eligible for both the CEWS and the 10% Subsidy, all amounts eligible to be claimed under the 10% Subsidy for remuneration paid in a specific qualifying period will reduce the amount available to be claimed under the CEWS in that same period. In the private sector, eligible corporations are limited to small Canadian businesses who meet certain criteria under the ITA.

Work-Sharing Program: Work-Sharing (WS) is an EI program that helps employers and employees avoid layoffs. EI benefits received by employees through an approved WS arrangement will reduce the benefit that their employer is entitled to receive under the CEWS.

Payroll Contributions: Employers are entitled to a 100% refund of their contributions to EI, the CPP/ QPP and QPIP (Quebec only) on behalf of an employee for each week that the employer is eligible for the CEWS and during which the employee is on leave with pay if the employee does not do any work that week. Employers can apply for the refund for the applicable qualifying period when applying for the CEWS for that period, and there is no limit on the amount that can be refunded.

How to Make a Claim

Since April 27, 2020, employers have been able to apply online for the CEWS through their CRA “My Business Account.” All applications must be filed before February 2021. The government has indicated that the subsidy is considered government assistance and must be included in the employer’s taxable income.

Before applying, employers are required to calculate the estimated amount of the wage subsidy to be claimed. The CRA has provided an “online calculator” in the form of an EXCEL spreadsheet that can be used for this purpose. The calculation must be performed for each payroll program account the employer has with the CRA. The website contains links to an application guide and the frequently asked questions with supplemental information to assist employers with preparing for the application process.

Employers can generally expect to receive payment within 10 business days, if registered with the CRA for direct deposit. Some applications may be selected for a pre-claim review.

Employers expecting a payment of over $25 million must be registered for both direct deposit and the Large Value Transfer System.

Beginning June 1, 2020, applicants have been able to request adjustments or changes to applications that have already been submitted. Employers need to make sure they continue to meet eligibility requirements for any updated claims, and keep records supporting the wage subsidy claim adjustment. Bill C-20 also introduced the ability of an employer to appeal to the Tax Court of Canada a CEWS decision issued by the CRA through a notice of determination.

The CEWS website contains additional information about eligibility, along with additional helpful examples of how the subsidy is calculated.

Record-Keeping Requirements

Employers are expected to maintain adequate books and records to ensure that their claims are accurate and complete. Books and records should clearly support the employer’s eligibility for the wage subsidy in a given qualifying period.

To support an employer’s claim that the revenue has declined, adequate calculations should generally be prepared and maintained. The CRA has indicated that it will be reasonable with respect to small employers that do not maintain detailed monthly records. However, any assumptions made in a calculation should be included in the documentation and available for review. Large employers should not expect to receive such leniency.

A signed attestation and record of any elections made for the purposes of determining “qualifying revenue” must also be maintained and made available to the CRA upon request.

Reporting Requirements

Employers are expected to report the eligible remuneration paid to each employee in respect of the qualifying periods using a new code in the “Other Information” section at the bottom of employees’ T4 slips. The government has committed to providing more information on T4 reporting requirements before the end of 2020.

Penalties for Misuse

Employers who claim the subsidy but do not meet the CEWS eligibility requirements will have to repay the subsidy. Penalties, including fines and imprisonment, could apply if the claim was submitted fraudulently.

Employers who attempt to artificially reduce their qualifying revenues in order to claim the CEWS will have to repay 125% of the value of the improperly claimed subsidy.

If an employer knowingly, or under circumstances amounting to gross negligence, makes a false statement or omission in its wage subsidy application, the employer is liable to a penalty of up to 50% of the difference between the amount of wage subsidy that it claimed in its application and the amount of wage subsidy to which it is actually entitled.

If a person (such as an accountant or tax preparer) files or prepares the CEWS application on behalf of the employer, they could be subject to a third party penalty under the ITA if they know, or would reasonably be expected to know, that the application contains a false statement or omission of information.

Public Information

It should be noted that the Minister of Finance is authorized to communicate to the public a list of every employer who has applied for the CEWS. The CRA has indicated that is currently considering its options for making this information public.

Understanding the CEWS is critical for many employers. We continue to monitor all developments regarding the CEWS and the other COVID-19 related initiatives introduced by the federal government.

Should you have any questions, please contact any member of our Pension, Benefits and Executive Compensation practice group.

The articles in this client update provide general information and should not be relied on as legal advice or opinion. This publication is copyrighted by Hicks Morley Hamilton Stewart Storie LLP and may not be photocopied or reproduced in any form, in whole or in part, without the express permission of Hicks Morley Hamilton Stewart Storie LLP. ©